The Definitive Guide to Org Charts

Everything You Wanted to Know About Org Charts (But Were Afraid to Ask)

The Definitive Guide to Org Charts — everything you need to know to build or buy organizational charts of target companies and competitors. Org charts — known as organization charts, organizational charts, and company hierarchy charts — are your new superpower in senior executive search. A company hierarchy chart tells you more than you could possibly imagine. An organization chart reveals competitive intelligence; corporate strategy; financial services and M&A; sales and marketing; corporate restructuring; organizational design, and precisely where the talent you are seeking exists.

What makes us org chart experts? Intellerati is an investigative research firm that offers custom org chart research. It is what we do and we’ve been amazed at the ROI. In fact, our corporate clients have been so blown away by the transformative power of org charts that they inspired us to write the definitive guide.

Why Tell You How to Build Your Own Org Charts?

Now you may wonder why we are including information that you can use to build your own org charts. You may even ask why we are listing our competitors — other org chart research firms — in addition to Intellerati in our guide to organizational charts.

The answer? We know Intellerati may not be the right choice for every research firm for every engagement, every time. Yet, we want you to have all the information you require to determine how to get the org charts you need. By paying it forward, we build trust and lasting relationships.

Organizational Chart Overview

Org charts are simple yet powerful things. That is one of the primary lessons to learn from our definitive guide to org charts. They give you a line of sight into an organization, whether it is a direct competitor, a company in an adjacent industry, or another kind of organization entirely. Put another way, org charts serve as a kind of treasure map, only the treasures you discover are precious competitive insights that few others have.

What is the Definition of an Org Chart?

By definition, an organizational chart is a graphical depiction of who reports to whom, all the way up to the Chief Executive Officer. At one glance, an org chart shows you the company’s structure — the divisions, departments, and/or product teams. It shows you talent distribution geographically. It also tells you where the company makes things, where it sells things, where it is pulling up stakes, and where it is setting down roots.

Often, the levels of a company’s organizational structure are denoted as N-1, N-2, N-3, and so on. N refers to the top executive, frequently the Chief Executive Officer, and the number denotes how many direct reports the role is from the CEO. An executive who is a direct report of the CEO is an N-1. That executive’s direct reports are then N-2, two degrees away from the CEO. An N series is simply an expression of hierarchies. In org charts, this is the hierarchy of the company.

The Business Case for Org Charts

Org Charts Are Your New Superpower

Org Charts are incredibly powerful. In fact, they could be your new superpower in senior executive search. But that is not their only application. They power up competitive intelligence; corporate strategy; financial services and M&A; sales and marketing; corporate restructuring; and organizational design.

Yet Org Charts Are Hard to Find

However, while org charts offer incredibly valuable information — finding target company and competitor org charts is not easy. You cannot purchase and immediately download an organizational chart of a target company of your choosing. Rather, you likely will need to hire a research firm to build the chart for you from scratch or you will need to do the research yourself.

Business schools, including The Kellogg School of Management at Northwestern University, teach the value of original organizational chart research of other companies. Another lesson to be learned from The Definitive Guide to Org Charts for Executive Search is that academicians study organizational charts as well.”Analyzing a firm’s organizational structure can . . . reveal much about the competencies and areas of competitive advantage within the organization” — according to research by David Besanko, a Professor of Management and Strategy at The Kellogg School of Management at Northwestern University, and by his colleagues Pierre Régibeau and Katharine Rockett of the University of Essex.

“Much like an architectural blueprint, a firm’s organizational chart can reveal important insights into the inner workings of the firm. Managers, analysts, and consultants can easily glean information about the structure—and even draw inferences about a firm’s culture—by knowing both the number of levels in an organization and the size of teams reporting to each person on the chart.”

(For more specifics on their research, see “Reading the Org Chart“.)

Org Charts Help You Understand Competitors

Custom org charts show you how competitor companies are structured. They reveal the layers. They provide a roadmap to competitor talent. No need to source on LinkedIn. You have them all in the org chart. Custom org charts also provide valuable insights into what kind of talent the company uses, which sheds light on their operations. If they’re staffing up in new functional areas, they may have new products in the works. If they’re rightsizing or reducing teams, they may be pivoting in another direction.

Who Uses Org Chart Intelligence?

The “managers, analysts, and consultants” who use org chart intelligence include executives (at your competitors, perhaps), Wall Street analysts, and management consultants at the leading strategy consulting firms. In other words, financial services firms, investment banks, and hedge funds glean insights from organizational charts to make lots and lots of money. Strategy consulting firms such as McKinsey & Company, Bain, and Boston Consulting Group use the information they develop from organizational charts to help their clients become more profitable.

And, yes, if you work at a large corporation or in a highly competitive industry, it is likely one or more of your competitors have built organizational charts of your company to help them take market share and human capital from you.

Org Chart Use Cases

Corporate Strategy

Org charts are an essential tool for strategic and competitive intelligence (CI). The CI firm Fuld + Company defines competitive intelligence as “the collection and analysis of information to anticipate competitive activity . . . It is an essential component to developing a business strategy.”

Financial Services

Wall Street uses org charts to evaluate companies for investment purposes. The graphical depiction of a company enables analysts and investors to see how a company has set itself up. For example, investors may discover a company has an extremely hierarchical and centralized structure. From this information, investors may decide that this company is bureaucratic and slower-moving than other decentralized, product-centric companies. Increasingly, the competitive advantage in financial services goes to investors with the inside scope org charts can provide.

Sales and Marketing

Sales, marketing, and account management teams use org charts to identify and cultivate relationships with potential clients. Sales teams regularly use prospect org charts to understand and better navigate the complex relationships of key executives. Especially those involved in making buying decisions. For marketing teams, org charts ensure they know which enterprise decision-makers to influence. Account management executives also use org charts to hold their clients close and grow the account.

Talent Acquisition

Org charts are regularly used for recruiting. They show executive leadership and talent acquisition teams where each type of talent is located. Org charts are, quite literally, graphical depictions of talent pools. Especially when combined with candidate profiles, org charts can help speed time-to-hire. They help companies better understand what it will take to hire the talent they need.

Organizational Design and Corporate Restructuring

Competitor org charts are a must-have tool for organizational design. As the rate of change in business accelerates, companies are shape-shifting for competitive advantage. Companies reorg and restructure to bring down costs, spur new growth, and strengthen profitability.

But where, exactly, to begin? The org charts of your competitors usually are a great place to start. Examining how a competitor is structured can inform the decisions you are making regarding how to structure your own company. It offers you competitive intelligence that you can take to the bank. In fact, org chart intelligence can be harnessed for organizational design to drive profitability.

The Business Case for Org Charts

Org Chart Benefits

Org Charts Show You Who They Are

An executive and employee hierarchy shows you who they are. You can not fully grasp all that a company is until you see the organization laid out in front of you. Is the org chart centralized with lots of levels, or is it flat and distributed? Is the org chart customer-centric (organized around customer groups, or product-centric) or both? Do most employees work out of company headquarters or do they have offices wrapped around the world?

Org Charts Separate the Forest from the Trees

Custom organizational charts are designed to bring order to data chaos. They organize company and employee information that, in its original form, is wildly disorganized. There is no way you can figure out a company’s structure by visiting a social media profile or reviewing a single contact record in your CRM database.

Org Charts Transform Unreliable Information

Original org chart research transforms unreliable information into data that can be trusted. For instance, LinkedIn profiles are often outdated and frequently lack important career and contact detail. In fact, you no longer can export the contact information that your first-degree LinkedIn connections have shared with you. Moreover, significant slices of talent do not hang out on LinkedIn. For example, we’ve observed many highly sought-after AI and data technologists avoiding LinkedIn. They simply don’t need to go there.

Executive Search Org Charts Fill Critical Openings

Org charts help you fill “impossible to fill” openings. For example, data science and artificial intelligence searches are notoriously challenging, so much so that news of the shortage made the New York Times in Tech Giants Are Paying Huge Salaries for Scarce A.I. Talent. What’s an employer supposed to do with that information?

They Develop State of the Market Intelligence Reports

Increasingly, our clients are asking us to deliver org chart research with our State of the Market intelligence reports to inform their thinking about what kind of talent they need. The intelligence report helps our clients figure out what talent pools to target and what to avoid. It also tells them how other companies are coping with the shortage. The report details what perks and benefits they offer to attract and retain talent. Increasingly, clients are conducting this research to inform corporate and talent acquisition strategies before they initiate a critical executive or technology search.

Org Charts Make You More Competitive

Org charts, when combined with intelligence reports, enable you to spot patterns you would not otherwise see. Imagine all the responsibilities executives and technologists have at leading companies. Their activities generate information ripe for analysis. Intelligence reports focused on the talent ecosystem help a company become more competitive and more profitable.

For example, one such analysis that we did for a leading Fortune 100 technology company shaved six months off of the product development cycle, identified emergent competitors, and teed up companies for M&A. The return on investment for that org chart engagement amounted to millions of dollars.

How to Obtain Target Company Org Charts

Determine if Org Charts Are Really Necessary

One of the biggest mistakes we see is companies ordering up org charts when what they really need is a tight list of target potential candidates or clients. If you are working on a tactical level, you likely do not need an org chart. And if you need intelligence to inform your talent acquisition strategy, investing in an organizational chart makes sense. Org charts of other companies may be worth the investment if any of the following apply;

- If you recruit out of the same companies over and over again

- If the talent you are seeking is challenging to recruit

- If you want to understand where the talent you need is located

- If you want to identify essential talent and ensure diversity

- If you want to gain a competitive advantage in talent acquisition

Build or Buy Executive Search Org Charts?

Org chart research, by definition, is labor-intensive. It also takes investigative research expertise. Consequently, if you want to build it, your internal team will need to have the necessary research abilities, the tools, and the time to gather the information. After they develop the data, you’ll need a software program or cloud solution to transform your data into a chart. What follows is a list of org chart solutions that transform the raw data into a graphical depiction of the org chart hierarchy. In other words, the org chart software and cloud solutions are empty vessels. Someone has to generate the data — do the actual org chart research

Are competitor org charts okay to use?

Custom Org charts Are a Legal, Best Practice

We do not obtain org charts from the company itself. If only it were that easy. While we always recommend checking with your legal team, our lawyers have advised us that it is legal to build org charts based on public information. It is research, pure and simple.

Companies may try to claim that their org charts are proprietary, closely-held information. To avoid any issues, we do not recommend obtaining the target company’s internal org charts. Moreover, expertly researched custom org charts may not be identical to internal org charts. Yet, as close approximations, they are incredibly valuable

Custom Org Charts are Built from Public Information

For example, companies regularly give away the names and titles of their employees on their company websites, business cards, and on social media. That information is also shared publicly by the employees themselves. Reporting information — who reports to whom — is often expressly stated or implied by the company in press releases and corporate biographies. Additionally, while it may take educated guesswork, a person’s direct superior often can be inferred from the Title and other types of public information. In general, for information to be considered proprietary, companies must treat it as confidential. Research conducted using public information is just that — research.

Most Companies Do Not Share Internal Org Charts

Most companies do not share that information with the public for a reason. A company org chart provides a road map to recruiting virtually anyone at the organization. It provides powerful insights into how a company does its work, where it does its work, and so much more. Org charts hold a kind of secret power. Clients typically use competitor org charts for benchmarking leadership talent and organizational design. Chief Revenue Officers and sales teams use org charts for sales prospecting. This form of talent mapping is also used for executive recruiting because competitor org charts make executive search ridiculously easy. Many of our clients are highly-regarded global corporations listed in the Fortune 1000 and Global 2000.

Org chart software and cloud solutions

Insperity OrgPlus

Insperity’s OrgPlus enables users to create org charts in multiple formats and in online. OrgPlus can build the organizational chart automatically. Simply import a spreadsheet of employees with a column for the direct superiors of each person in the chart. OrgPlus also allows users to customize the format and look of the chart as well as determine what fields are displayed.

Microsoft Visio

Microsoft Visio is another software program that can be used to build org charts. In fact, Microsoft has a “Create an Organizational Chart” video that shows you how to do it. While you also can use PowerPoint to build org charts, Visio makes it much easier. It enables you to import information from an Excel spreadsheet or other data sources and Visio builds the org chart for you.

Pingboard

Pingboard offers a cloud solution that makes it easy to share org charts with team members online. It is designed primarily as an employee directory for your company. So it is unclear whether their pricing facilitates org charts of multiple companies as a form of competitive insights and organizational intelligence.

Organimi

Organimi is an online org chart solution that we have used and that we recommend. You can also download Organimi charts in Adobe Acrobat PDF and PNG formats. You may also share the chart via a URL and by email. We are impressed by how easy the software is to use and by the responsiveness of the support team.

While there are plenty of software programs that will help you display data in the form of an org chart after the research is complete, you still need the data — at a minimum, the name, title, company, and direct superior — to populate the org chart. So if your team lacks the time, resources, and/or expertise to develop the reporting relationship intelligence, you’ll likely need to turn to an organizational chart research firm like Intellerati to conduct the original research for you.

How to select an org chart research firm

If you have decided you don’t want to build the target company org chart yourself, you likely will need to buy the research from an org chart research firm. To select the right firm for your needs, determine whether the research firm’s offerings align with your preferences

Organizational chart research firm types

- Database subscription services offer company and employee data-as-a-service with reporting relationships included. You don’t get the traditional graphical depiction an org chart to study with all the boxes. Rather, in the database’s list view, direct reports are indented under the direct superior. B2B database firms decide in advance what companies they will research. A client can’t specify what companies the firm covers or how deep the org chart goes. You can’t request that the chart focus on a specific type of talent, function, product team, division, or geography. You get what you get.

- Subscription publications offer some org charts as content. The organizational charts are designed to be viewed online behind a paywall, which you may access after you log in as a subscriber. Typically, the selection is small. You don’t get a research product with biographies and contact information that help you reach out to the people in the chart. But since the information is at-the-ready, it is worth considering in case the company you are seeking is one that they cover.

- Org chart wikis are websites that are created and edited by volunteers around the world. Research contributed by volunteer users is subject to error. Unlike the leading Wikipedia, org chart wikis do not appear to have a large enough or active enough user base to catch errors and contribute up-to-date content. Consequently, it is difficult to tell how reliable the information is. However, one org chart wiki appears to be taking steps to augment and QA the information.

- Custom research firms, including Intellerati, conduct original org chart research focused on the target companies that you want. In other words, they conduct the research just for you. The org chart research does not get shared with anyone else, such as your competitors, which gives you a competitive advantage. In addition, you typically have more control. You should be able to specify what the chart focuses on, such as how many levels you map beneath the CEO. You should be able to work with the firm to ensure the chart focuses on the kind of people who matter most to you. Moreover, you should be able to specify the kinds of information (fields) you want the firm to develop besides name and title.

Questions to ask org chart research firms

To select the right research firm, our Definitive Guide to Org Charts recommends you ask the following questions:

- How do you determine who reports to whom?

- How do you verify reporting relationships?

- What do you do in the absence of that verification?

- What other information do you attempt to confirm and how?

- How many total researchers do you have?

For subscription service, we recommend you ask yourself whether it is physically possible for their researchers to keep the database current. To do that, estimate a typical number of reporting relationships they’d be responsible for keeping current (along with the title, contact information, and other crucial details).

For example, a large company CEO typically has a leadership team of a dozen or more Executive Vice Presidents and C-level executives. To ballpark, let’s say each of those 12 executives has 8 senior vice president direct reports (12 x 8 = 96), and each of those SVPs has 8 vice president direct reports (12 x 8 x 8 = 768). That’s 768 relationships to verify at just one company. When you multiply that number by the total number of large companies in a subscription database, you end up with 2.5 million contacts whose reporting relationships need to be kept current. that the researchers are responsible for keeping current. There are millions more to be counted among the database’s medium and small companies . . .

When we assessed those data services, we determined that their researchers could not possibly keep that amount of data current. While we do subscribe to multiple database services, we have never found a reliable data service offering org chart data by subscription. (Please let me know if you’ve found one that you like. I’ll update this post.)

Org chart research firms list

Aqute

Aqute is a competitive intelligence firm that offers organizational chart research. The company does not list the names of any of its leaders on its website. The company prefers to operate in permanent stealth mode. An Aqute job posting lists one job requirement as “Discretion. We’re not spies, but we do have to be discrete, and respect our client’s need for privacy.”

Corporate Navigators

Corporate Navigators is a recruiting research firm that builds org charts depicting the corporate hierarchy and reporting relationships at all levels and functions throughout a company – from individual contributor level all the way up to the CEO. Once the company completes the org chart research, it builds the classic org chart diagram and provides it in multiple formats.

DiscoverOrg

DiscoverOrg is a B2B data provider that offers data with reporting relationships built in. It doesn’t produce an org chart per se. Rather, it is a database that displays reporting relationships by indenting them under their bosses in a list view. Of all the research firms, it is the biggest that just made itself even bigger by acquiring ZoomInfo. When we last checked, there is no way to purchase individual org charts from them.

Intellerati (That’s us)

Intellerati is a boutique recruiting research firm that conducts candidate sourcing and talent mapping research to create online custom org charts. The charts include biographies, contact information, and available profile photos for each executive. The org charts are tailored to the preferences of clients and often are delivered with a State of the Market intelligence report.

Qualigence

Qualigence is a recruiting research firm based in Livonia, Michigan, that offers organizational charts. They are “hyper-targeted breakdowns of your competition’s inner workings, like their top performers, how to reach them, reporting structures, and lines of communication.” Like other offerings, its org charts include name, title, company, and contact information.

RW Stearns

RW Stearns Inc. provides research-based recruiting solutions to companies ranging from emerging startups to those in the Fortune 1000. It lists org charts among its research offerings. The website says the company has completed more than 16,000 projects — domestic and international — spanning all industries, ranging from CEOs to individual contributors.

SGA Talent

SGA Talent is a recruitment research firm based in Amsterdam, New York. The firm’s offerings include Organization Charts and Talent Mapping. The org charts provide “valuable data used for proactive recruiting efforts to build candidate pipelines for current and future roles” and are a go-to resource for understanding a competitor’s post-pandemic structure.”

The Information

The Information is a technology publication that also offers organizational charts for 35 large companies that it follows, most of them in technology. You need to log in with a subscription at $399 per year to view the org charts on their web interface. In other words, you can’t download them. Here, they explain how they do the research for the charts.

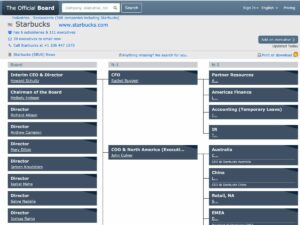

The Official Board

The Official Board is a global data boutique providing detailed corporate organizational charts and executive movement alerts in structured formats. says it provides the org charts on more than 80 thousand companies with $100 million in revenue. The org charts detail decision-makers (Board, N-1, N-2) and are updated by algorithmic detectors that track executive moves.

How to maintain org chart research

Organizational charts start aging the moment the org chart has been completed. Another lesson from our Definitive Guide to Org Charts is that the data in them must be refreshed. Changes in leadership and reorganizations have a way of making mincemeat out of custom org charts. Their half-life, on average, is about 9 months. At that point, while some of the research will remain correct, there will be enough outdated information to make it an unreliable representation of the company. After a year and a half, so much information is incorrect it makes more sense to start from scratch than to attempt to update the original chart. For one-off studies of target companies, you don’t need to worry about maintaining org chart research. However, for companies you want to continually track, we advise refreshing the information quarterly.

Competitor Org Charts for Organizational Design

Competitor org charts are a must-have tool for organizational design. As the rate of change in business accelerates, companies are shape-shifting for competitive advantage. Companies reorg and restructure to bring down costs, spur new growth, and strengthen profitability. But where, exactly, to begin? The org charts of your competitors usually are a great place to start. Examining how a competitor is structured can inform the decisions you are making regarding how to structure your own company. It offers you competitive intelligence that you can take to the bank. In fact, org chart intelligence can be harnessed for organizational design to drive profitability.

Org Charts for Cost-Cutting

If your goal is cost-cutting, competitor org charts are a powerful tool to inform thinking about how best to do that. Cost-cutting doesn’t always mean reducing headcount. For example, if the percentage of the overall headcount for your competitor’s IT team is twice the size of your company’s team, but other teams are comparatively smaller — it may suggest that they’re using technology to keep costs and headcount low. If that’s the case, upsizing your IT team may help you save money.

Org Charts for Streamlining

Studying the org charts of profitable competitors can also help you figure out how to best streamline your organization to reduce costs and drive efficiency. Eliminating a layer of middle management, an under-utilized function, or an underperforming business may look good as a line item in a financial statement. But change agents need to make sure that they don’t break a company’s ability to function. A corporate structure that facilitates efficient workflow and enables future changes without disruption is ideal. Looking at the organizational design of competitors (or other kinds of companies) can give you ideas about how to structure your own organization.

Org Charts for Digital Transformation

Digital transformation is a huge driver in organizational design. However, you can’t just plug the latest technology into existing systems and expect everything will run like clockwork. You must consider how that technological advancement will affect the entire organization. Digital transformation often transforms how work is done, how the org structure is designed, what skills and talent are needed, and where people will work. Examining the organizational design of technically forward-leaning organizations is a great way to think through the kinds of people, departments, divisions, and locations you will need.

Org Charts for Agility

If you want your organization to respond to market opportunities more quickly, structuring your organization to make it more agile is another form of transformation. Corporations that pursue this kind of change often look to agile companies such as Amazon to benchmark “best practices” in organizational design. Amazon is a famously flat organization. They push decision-making down to the director level, in effect making those leaders general managers of a product or service. Their teams work as if they were their own businesses. Team members feel a stake in the outcome. As a result, they are agile: they move with lightning speed and seize the advantage. Are there lessons to be learned from studying their org chart? You bet.

Summary

Organizational chart research done well is a form of competitive intelligence. Naturally, The Definitive Guide to Org Charts for Executive Search recommends that organizational chart research be done well. To qualify, it must do more than simply gather information about reporting relationships. Rather, it must analyze the information to transform it into actionable intelligence that informs business strategy. It is all about connecting the dots and seeing patterns others miss for competitive advantage. That is why org charts are powerful things. They are not to be underestimated.

Got questions? Let’s talk.

If you’d like to explore possible ways to work together, let’s talk. We understand that no recruitment research firm is the right firm for every engagement every time. But, regardless, we make it a practice to listen and to try to help.